How Best Home Loan Refinance Offers can Save You Time, Stress, and Money.

Table of Contents3 Easy Facts About Best Refinance Offers ShownThe 9-Minute Rule for Refinance DealsThe Best Strategy To Use For Best Refinance OffersThe Ultimate Guide To Best Home Loan Refinance OffersThe Only Guide to Refinance DealsMortgage Refinance Deal - An OverviewUnknown Facts About Best Home Loan Refinance OffersA Biased View of Best Refinance Deals

You have your primary mortgage, and now you're taking a second loan versus the equity you've developed in your home. The 2nd loan is secondary to the firstshould you default, the 2nd lender stands in line behind the very first to gather any earnings due to foreclosure. best refinance offers. Home equity loan rates of interest are usually greater for this factor.There are numerous benefits to home equity loans that can make them appealing options for property owners seeking to reduce their monthly payments and simultaneously release a swelling amount. Refinancing with a home equity loan can provide: Lower, repaired rates of interest than your previous mortgage, Lower month-to-month payments due to lower interest rates and a smaller principal, A lump amount that can be utilized for any function, including restorations and enhancements to your property that, in turn, can raise its worth On the other hand, house equity loans featured risks that you ought to understand: Your home secures the loan, so your home is at risk if you fall back on your loan payments.

The Ultimate Guide To Best Refinance Deals

If you don't end up needing the entire quantity, you can be stuck paying interest on a part of the loan you do not utilize. This is why HELOCs are a better choice for house owners who require to cover continuous, unforeseeable costs. You can't get a home equity loan with too much financial obligation or bad credit.

There are numerous factors why you might select a cash-out refinance over a home equity loan. In principle, a cash-out refinance offers you the quickest access to the money you have actually already bought your property. With a cash-out refinance, you settle your current home loan and enterinto a brand-new one - best home loan refinance offers.

The 6-Minute Rule for Best Refinance Deals

On the other hand, cash-out refinancing tends to be more pricey in regards to fees and percentage points than a house equity loan is. You will also need to have a terrific credit rating in order to be authorized for a cash-out refinance since the underwriting standards for this type of refinancing are generally higher than for other types - best refinance deals.

The cost of home equity loans tends to be lower than cash-out refinancing, and this type of refinancing can be far less intricate. House equity loans also have drawbacks.

Some Of Mortgage Refinance Deal

In other words, with a cash-out re-finance, you borrow more than you owe on your home mortgage and pocket the difference. Not usually. You do not need to pay income taxes on the money you get through a cash-out re-finance. The money you collect from a cash-out re-finance isn't thought about earnings.

Rather of income, a cash-out re-finance is merely a loan. Cash-out refinancing and home equity loans can benefit homeowners who wish to turn the equity in their homes into money. To decide which is the best relocation for you, consider how much equity you have available, what you will be using the cash for, and for how long you prepare to remain in your home (best refinance deals).

Top Guidelines Of Mortgage Refinance Deal

This will not just indicate you're mortgage totally free sooner, however will likewise conserve you on interest. When you were wading into the world of home loans for the very first time, you might have chosen to keep things basic with a basic no-frills alternative. go Now that you've had that loan for a few years (or a years) you may desire to refinance to an option with a few more functions, like an offset account, extra payments or a redraw facility.

A Biased View of Best Refinance Deals

As soon as you have actually settled some of your loan and pop over to these guys your LVR reduces, you may be able to snag a better rate of interest. Possibilities are, some things have actually changed since you first signed up for your home mortgage. Possibly you got a brand-new task, or you had kids, or you paid off other debts that were dragging you down.

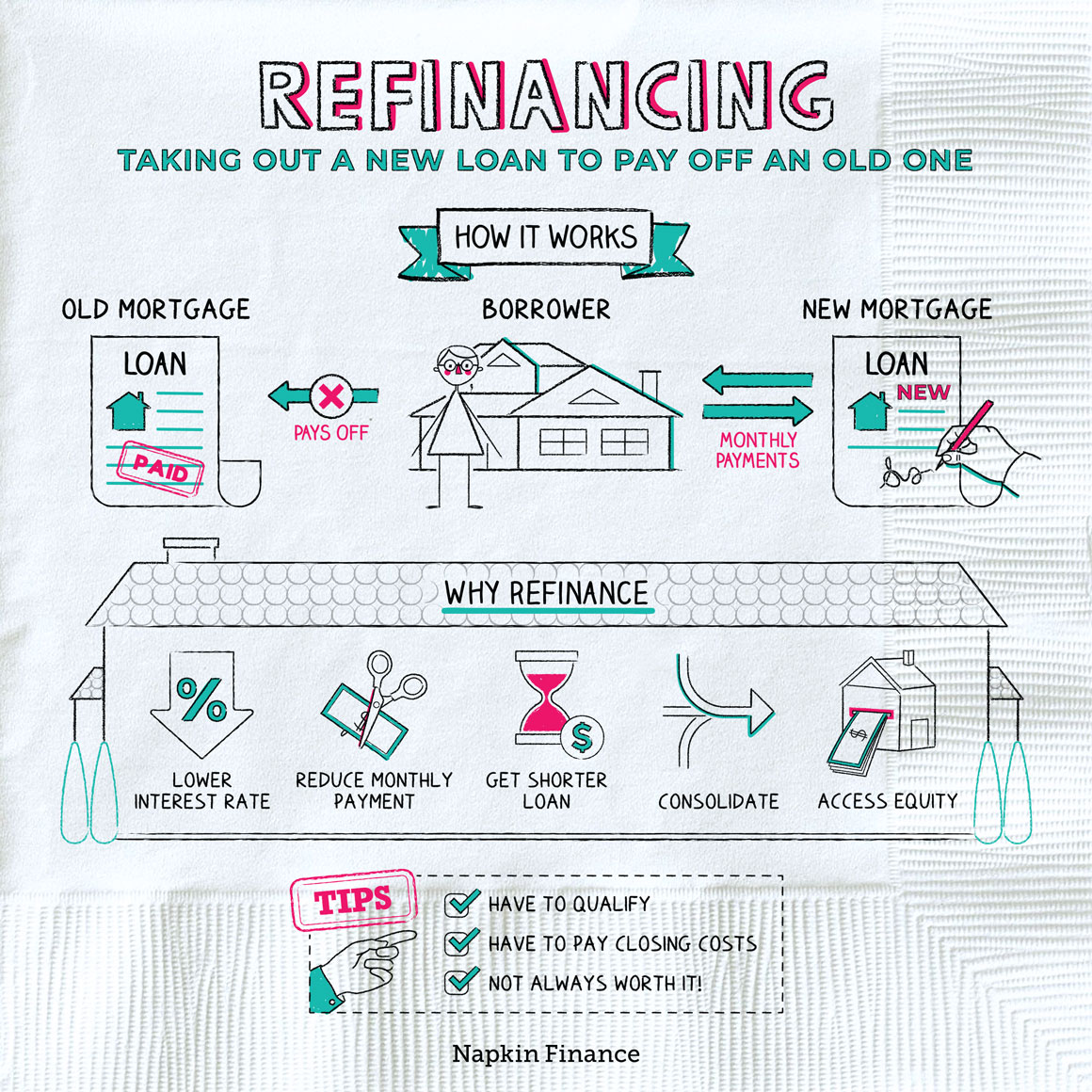

It's constantly an excellent concept to examine your home mortgage every couple of years, to make certain that you're still getting a bargain. Once you've reviewed it you might even begin considering refinancing. Refinancing your mortgage merely implies that you take out a brand-new mortgage to replace your old one.

How Mortgage Refinance Deal can Save You Time, Stress, and Money.

When you switch home mortgage you will typically need to use some or all of the funds to settle your old home loan - refinance deals. Depending upon what works best for you or what try this offers are offered when you're wanting to refinance, you can either stick with your existing lender or switch to a brand-new one entirely.

The 25-Second Trick For Refinance Deals

60% interest. If you have actually chosen to refinance your home loan to a better deal, now comes the challenging part of discovering the ideal house loan to change.

Comments on “8 Simple Techniques For Mortgage Refinance Deal”